Electronic Invoice: What is the difference between the DIR3 and DIRe codes?

On the way of the Public Administration towards the total digital transformation of its processes, i...

The Immediate Supply of Information (SII) is a new system for keeping VAT registration books and the IGIC that is carried out through the Electronic Headquarters of the Treasury. It entered into force on July 1, 2017 for the AEAT, on January 1, 2018 for the Regional Treasury and on January 1, 2019 for the Canary Tax Agency.

The SII obliges companies to declare and send electronically to the Platform provided by the Treasury the detail of the invoices 4 days after they have been issued or accounted for if they are received, bringing the invoice registration time closer to the effective realization of the invoices. The economic operation.

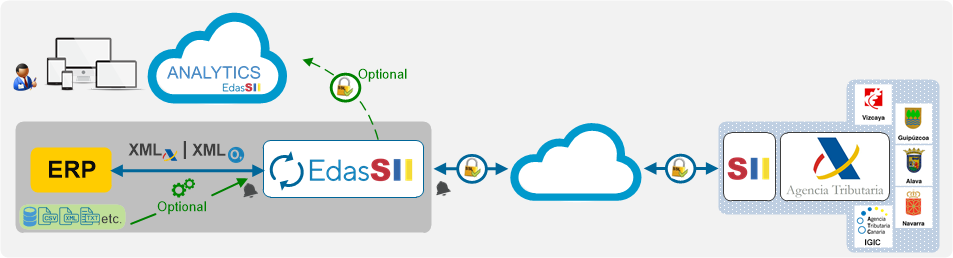

At ZeroComa we have developed a solution, EdasSII, which, with about 1,000 users, is one of the most prominent and used for the management of IBS. EdasSII is compatible with the SII of the AEAT, the SII of the Haciendas Forales and the SII of the Canary Islands.

The Tax Agency implements a new system of keeping accounting for the products subject to Special Taxes (SILICIE), in accordance with Article 50 of the Special Tax Regulation. From January 1, 2020, the obligation of keeping the accounting of the products subject to Special Taxes, and where appropriate, the raw materials used in obtaining them, will be carried out through the electronic Headquarters of the Tax Agency, by electronic supply of accounting entries.

At ZeroComa we devised EdasSII for all companies that need, by obligation or voluntarily, to adapt to this requirement. Our solution covers all the needs of an organization for compliance with IBS, with the power, versatility and simplicity that characterize our products.

-For the subjects obliged to the Immediate Supply of Information, the obligation to present models 347, 340 and 390 (415, 416, 425 and 340 in the Canary Islands) is eliminated.

– For the subjects obliged to the Immediate Supply of Information, the deadline for submitting self-assessments is extended to the first 30 calendar days of the month following the monthly settlement period.

Thus, the different Registration Books will be configured almost in real time:

It can be sent in two ways:

On the way of the Public Administration towards the total digital transformation of its processes, i...

ZeroComa has presented almost a hundred Spanish wineries with its star tool for sending to AEAT the...

On January 1, 2020, SILICIE, the new Accounting Book keeping system for the products subject to Spec...