Advantages of carrying SILICIE through its own accounting system

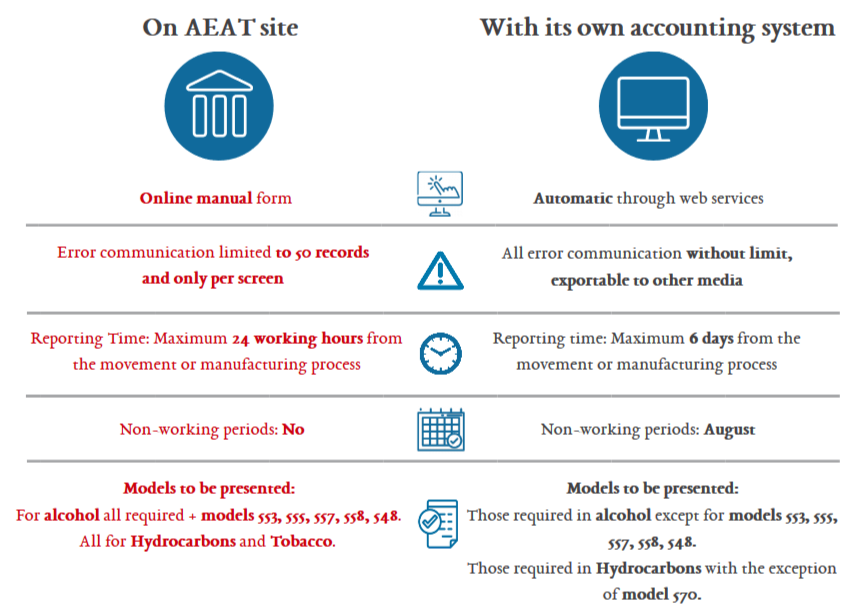

On January 1, 2020, SILICIE, the new Accounting Book keeping system for the products subject to Special Manufacturing Taxes, will be effective, as established in Order HAC / 998/2019, of September 23, published last October 5, 2019. The keeping of the accounting in own system and in electronic headquarters of the AEAT differ. Below we explain a series of advantages that own accounting systems have for carrying out this new requirement.

Companies affected by said regulations that do not benefit from their own accounting system before December 31 will be automatically registered in the AEAT to manually keep the accounting of said taxes through the Administration’s own electronic headquarters. This method will result in the impossibility of automation through the use of its own accounting system and in a series of disadvantages in terms of deadlines, validation of errors and others indicated below.

ZeroComa has developed the EdasSILICIE Solution for automating the presentation of accounting entries for processes, movements, stocks and raw materials affected by excise duties. It is emerging as the best option thanks to its power, simplicity of use, and ability to integrate with the tools and management solutions of organizations.

During the first year, if the company subject to SILICIE has its own accounting system for the connection with the Treasury, it may have up to nine days to communicate the information.

EdasSILICIE allows you to monitor the entire communication process with the Treasury, record each shipping process, improve control and enable significant cost savings.