Electronic Invoice: What is the difference between the DIR3 and DIRe codes?

On the way of the Public Administration towards the total digital transformation of its processes, i...

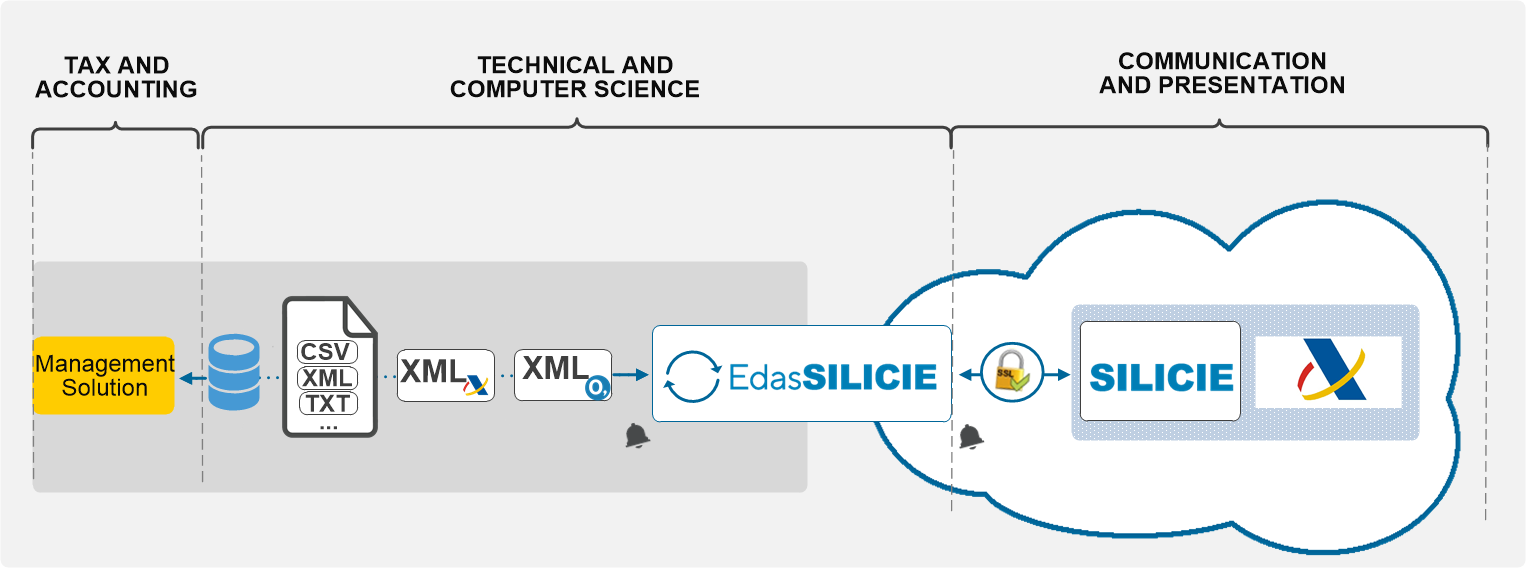

The Tax Agency implements a new system of keeping accounting for the products subject to Special Taxes (SILICIE), in accordance with Article 50 of the Special Tax Regulation. From January 1, 2020, compliance with the obligation of keeping the accounting of the products subject to Special Taxes, and where appropriate, the raw materials used in obtaining them, is carried out through the Agency’s Electronic Headquarters Tax, through the electronic supply of accounting entries.

The accounting must reflect the processes, movements and stocks of the products subject to Special Taxes and, where appropriate, of the raw materials necessary to obtain them, including the differences that are evident on the occasion of storage, manufacturing or circulation.

Among the main developments include the definition of accounting entries to be supplied, as well as the procedures, deadlines and form of presentation, and the reduction of information declarations (operations declarations will not be required when special tax accounting is carried out to through the electronic headquarters of the AEAT).

On the way of the Public Administration towards the total digital transformation of its processes, i...

ZeroComa has presented almost a hundred Spanish wineries with its star tool for sending to AEAT the...

On January 1, 2020, SILICIE, the new Accounting Book keeping system for the products subject to Spec...